Millions unprepared for retirement

10,000 older adults retire each day. 85% of retiree households are at risk of financial insecurity. It is estimated that 30-40% of those approaching retirement age have no savings and no pension. They rely on social security just to get by. Many older adults are just one crisis or health problem away from poverty. The one glimpse of hope is most of these older adults own a home with a significant amount of equity.

Many older Americans are unaware of the possibility of using their home equity to finance their retirement. If they are aware, most are uncomfortable and confused about how to tap their home equity. For those in extremely dire situations with limited incomes, a possible solution is a reverse mortgage. Unfortunately, predatory lenders in the past had tainted the reverse mortgage name.

From napkin sketch to prototype

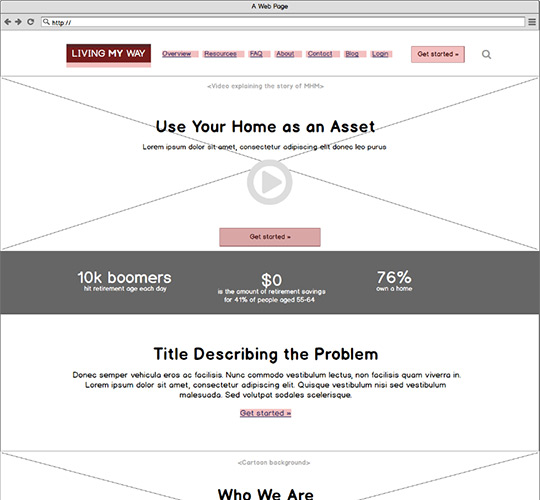

Living My Way was a working project with the goal of creating a website that would educate users about thinking of using their home as an asset. The website would educate users about home equity lines of credit, reverse mortgages, home sharing, relocation services, and home modification.

NCOA started out by doing a significant amount of research and funded external research by 3rd party experts to validate the product idea. Lastly NCOA funded focus groups in 3 cities in the US about retirement. I provided feedback on the screeners to ensure we had the right people in the focus groups and gave guidance on topics to be discussed. The research revealed a lack of understanding of home equity products and a negative bias against the reverse mortgage line of credit based on product name and preconceived notions of the product. Based on product features alone, consumers and financial advisors preferred a reverse mortgage line of credit to a home equity line of credit, which supported the need for education around safe and appropriate ways to use home equity products to address retirement needs.

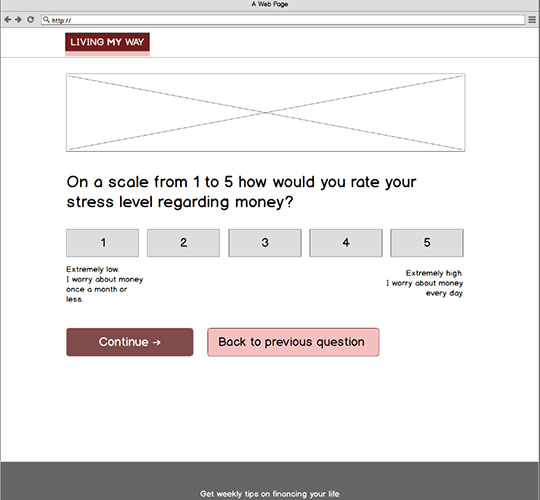

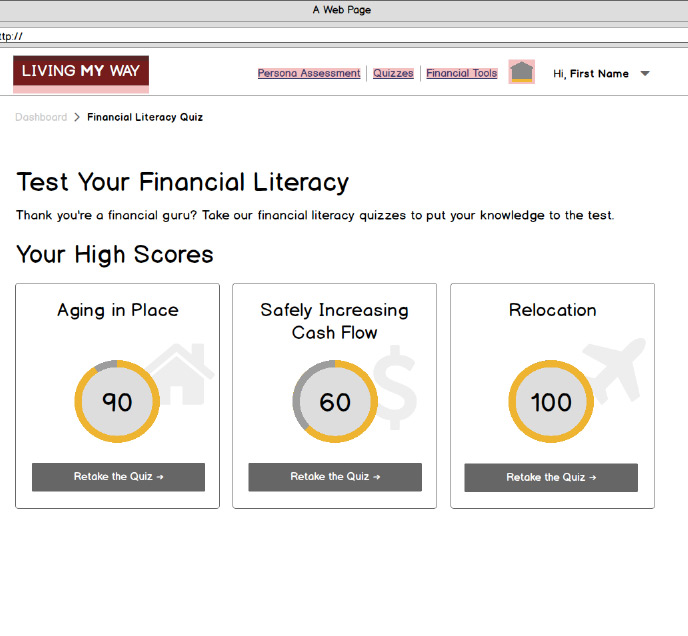

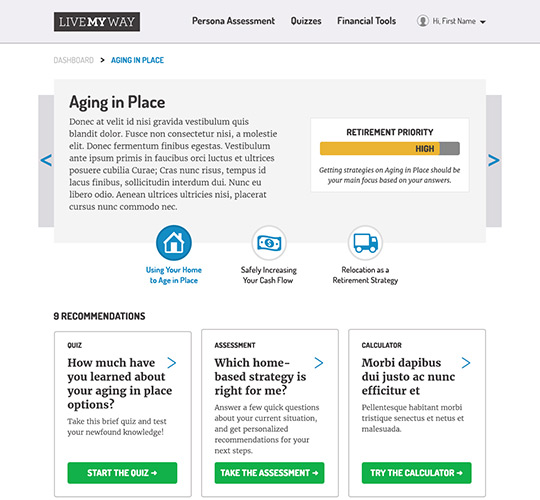

With my team, I started out by first having whiteboard sessions to figure out what exactly we were looking for in a product. From there I created wireframes to sketch out the scope of the project. Business requirements were gathered and assessed. I produced a low-fidelity prototype to bring the discussions from high level concepts into a product that was more tangible and refined. The concept changed names a few times from My Home Matters, to Live My Way to finally Living My Way. Mockups were then created to convey branding and design. I started producing a high-fidelity prototype when the project came to a halt.

I designed a product that would:

- Assess a user’s personal situation to understand their pain points and needs

- Score and rank solutions available to users for ideal fit

- Educate users on these different options available to them with a gamified experience

- Assess their knowledge and misconceptions

- Provide them with financial tools and calculators to assist the decision-making experience

- Handoff users with trusted partners that met NCOA’s strict standards

- Give users hope in difficult times

Aligning partnerships and securing funding

Based on my product design, NCOA created partnerships and secured funding from two large organizations in the reverse mortgage industries, with more partnerships in development. Ultimately NCOA decided the timing was not right to move forward with the product. However, the work is currently being integrated in an upcoming comprehensive financial wellness platform to help struggling older adults.